Hear From Kevin O'Leary

Hear From Kevin O'Leary

Chairman & Co-owner

Chairman & Co-owner

Hear from Kevin O'Leary

Chairman & Co-owner

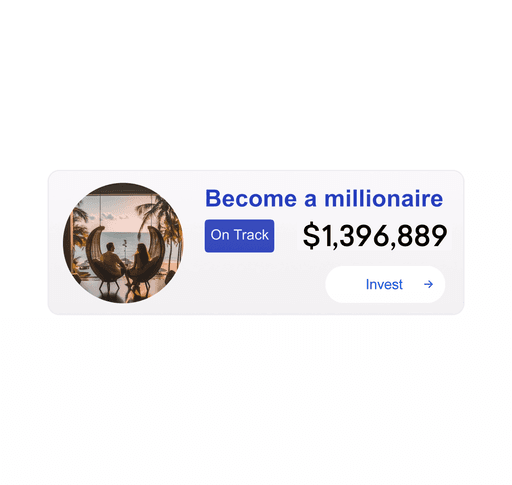

Wealth Builder

Wealth Builder

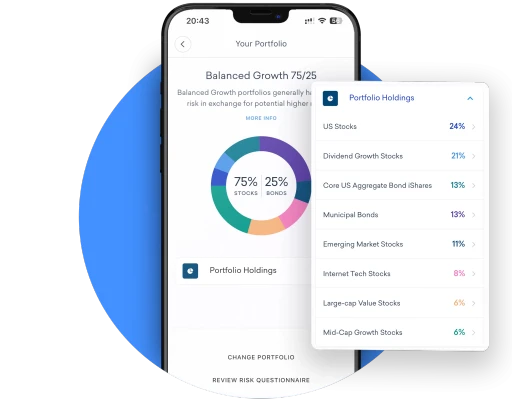

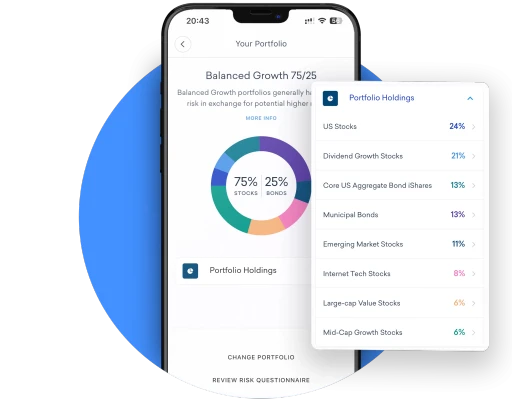

Your Personalized Portfolio

Your Personalized Portfolio

Your Personalized Portfolio

Diversified expert-built portfolios are not just for the wealthy. Included with Beanstox Plus, Wealth Builder is your personalized ETF portfolio diversified into investments including: the US Market, Tech, Dividend Growth, as well as Bonds to reduce risk in some portfolios. All this for an affordable $5 subscription fee.

Diversified expert-built portfolios are not just for the wealthy. Included with Beanstox Plus, Wealth Builder is your personalized ETF portfolio diversified into investments including: the US Market, Tech, Dividend Growth, as well as Bonds to reduce risk in some portfolios. All this for an affordable $5 subscription fee.

*See Disclosures below

*See Disclosures below

Featured in

Featured in

Fully Automated Wealth Building

No Experience Needed

No Stock Picking, No Market Timing, No Experience Needed! Benefit by owning many stocks without the stress of stock picking, market timing, and other hassles.

Invest For Your Investment Goal

Beanstox builds a personalized ETF portfolio for long-term investing to match your investments goals and risk profile. Deposit and add to your investments or withdraw at any time.

Diversification

Avoid putting all your eggs in one basket. Beanstox aims to enhance your returns and reduce risk with an ETF portfolio diversified by geography, strategy, industry and asset class. A mix of ETFs means while some investments decline, others may go up.

No Experience Needed

No Stock Picking, No Market Timing, No Experience Needed! Benefit by owning many stocks without the stress of stock picking, market timing, and other hassles.

Invest For Your Investment Goal

Beanstox builds a personalized ETF portfolio for long-term investing to match your investments goals and risk profile. Deposit and add to your investments or withdraw at any time.

Diversification

Avoid putting all your eggs in one basket. Beanstox aims to enhance your returns and reduce risk with an ETF portfolio diversified by geography, strategy, industry and asset class. A mix of ETFs means while some investments decline, others may go up.

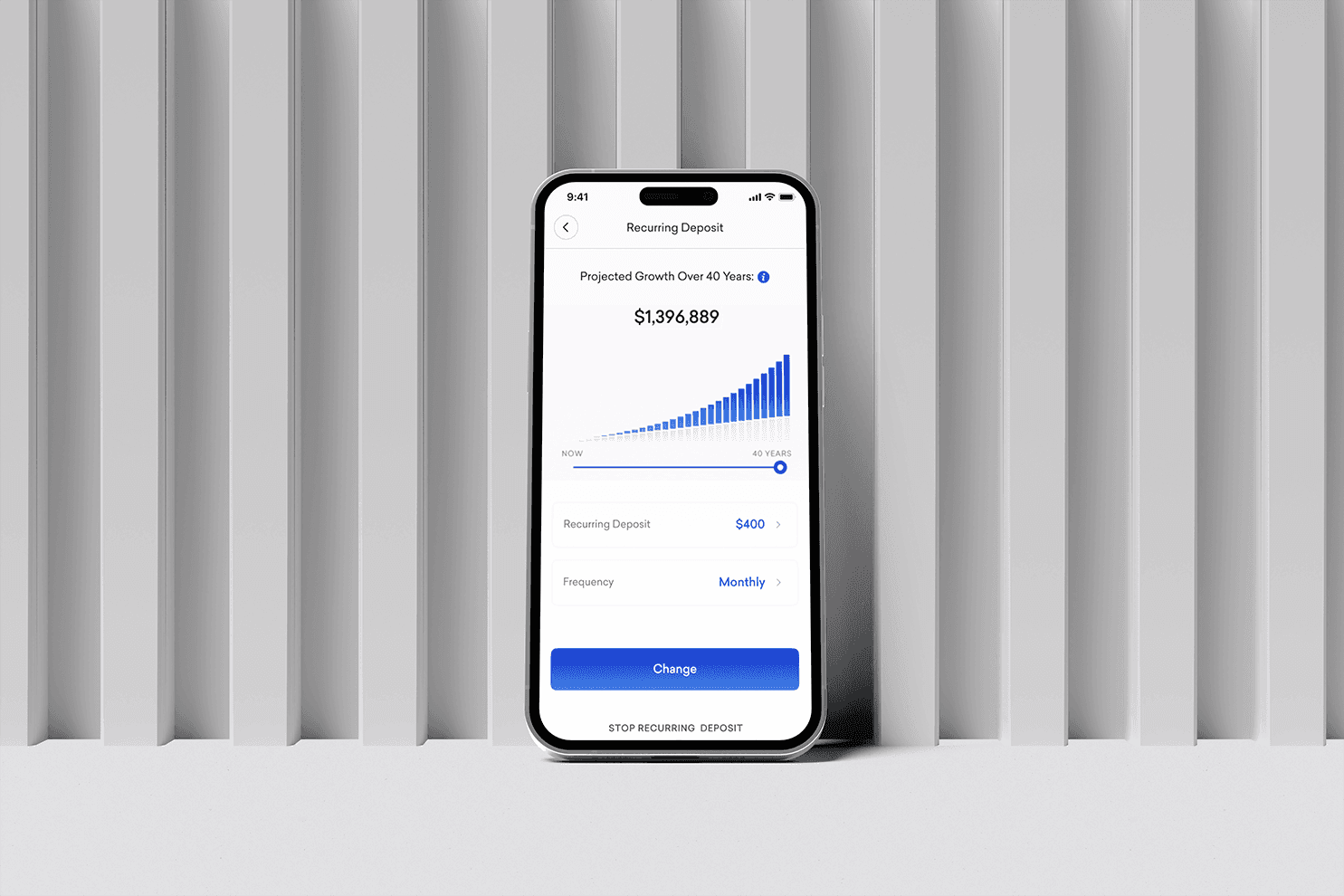

Set it and Forget it

Set it and Forget it

Automated Investing

Automated Investing

We do the work, so you don’t have to. Get automated recurring deposits, portfolio rebalancing and distributions reinvestments to grow your wealth faster! Weekly, bi-weekly and monthly options.

We do the work, so you don’t have to. Get automated recurring deposits, portfolio rebalancing and distributions reinvestments to grow your wealth faster! Weekly, bi-weekly and monthly options.

Built for You

Built for You

Answer a few questions and we’ll build an ETF portfolio to fit your investment goals and risk profile.

Answer a few questions and we’ll build an ETF portfolio to fit your investment goals and risk profile.

Investment & Finance Info

Investment & Finance Info

Get additional investment research, market commentary, and personal finance education exclusively for Beanstox Plus subscribers.

Get additional investment research, market commentary, and personal finance education exclusively for Beanstox Plus subscribers.

Get Started with Wealth Builder

Get Started with Wealth Builder

Seriously Simple Investing™ in the Palm of Your Hand

Seriously Simple Investing™ in the Palm of Your Hand

FAQ - Most Frequent Questions and Answers

FAQ - Most Frequent Questions and Answers

Beanstox Plus: What does my $5 monthly subscription fee cover?

When you invest with Beanstox Plus, we do all of the heavy lifting for you for a $5 monthly subscription fee. The $5 monthly subscription fee includes the costs associated with:

initially setting up your account

maintaining your account

transaction processing including buying and selling securities

account management tasks like making available statements and documents required by the SEC

Beanstox Premium: What does my $10 monthly subscription fee cover?

When you invest with Beanstox Premium, you get all of the Beanstox Plus benefits as well as Traditional and Roth IRA investment accounts.

You can read more about Beanstox Fees on our website along with our Advisory Agreement.

Are there any other costs associated with my Beanstox account?

No! There are no other additional fees for costs associated with portfolio advisory services, custody, account maintenance, or trade executions, unless those fees are related to foreign exchange or third-party asset fees. When you withdraw funds from your Beanstox account, you will incur a $0.25 charge, which will be subtracted from the total withdrawal amount.

The fees and expenses charged by ETFs to their shareholders are separate from, and in addition to, the Beanstox monthly fee. These fees and expenses are described in the prospectus of each ETF and are generally composed of a management fee and other fund expenses. Beanstox does not earn or receive a portion of such fees.

How do you build my portfolio?

Our portfolios are constructed by Beanstox and approved by its investment team which has decades of investment and portfolio construction experience. Answer a few questions and we’ll build a portfolio aimed at meeting your investment goals and risk tolerance levels based on your client profile. You will have some ability to customize the portfolio that we propose for you. You can also opt to decline the Proposed Portfolio and select a different portfolio offered by Beanstox.

How long does it take to set up my Beanstox account?

Everything about Beanstox is designed to make investing seriously simple, and that includes our sign-up process. In minutes, you can set up your profile, approve your personalized ETF portfolio (or select an alternative Beanstox portfolio), link your bank account, and set up a recurring bi-weekly or monthly deposit. Start investing on the right foot quickly so you can start building wealth over time.

To learn more, read How do I open a Beanstox account?

How do I know what to invest in?

Beanstox is a robo-advisor, therefore you simply answer a few questions, and we’ll help select Personalized Portfolios investments for you based on the investment goals and risk tolerance levels that you identify. You can also opt to decline the Beanstox Proposed Portfolio and select a different portfolio offered by Beanstox.

Learn with Beanstox

For a brief moment during the pandemic, investing looked like chaos disguised as opportunity.

For a brief moment during the pandemic, investing looked like chaos disguised as opportunity.

For a brief moment during the pandemic, investing looked like chaos disguised as opportunity.

A few minutes now can set up an entire year of progress.

A few minutes now can set up an entire year of progress.

A few minutes now can set up an entire year of progress.

Check Out the Beanstox App

Invest without stress. Easier than a walk in the park. No stock picking, no market timing and no experience needed.

Legal

Developers

Unless indicated differently, data is as of 12/31/2025.

*Disclosures

Beanstox does not provide tax, legal, accounting, budgeting, credit score, or banking advice. The information provided is for informational purposes only and is not intended to constitute such advice. Readers are encouraged to consult with their personal tax, legal, and accounting professionals for specific guidance.

** Open a Traditional IRA with Beanstox and boost your federal tax refund by up to $22 for every $100 you contribute by April 15, 2026 (or up to $1,540 assuming 22% on the maximum contribution of $7,000).

1. Pricing: Learn About Pricing.

2. Power Savings: As of Dec 31, 2025: traditional US Savings Account Rate: 0.39% (YCharts); T-Bill yield: 3.57% (YCharts); comparison based on 3.66%, the 30-day SEC yield of the Beanstox short-duration bond portfolio ETF constituents; the 30-day SEC yield is a standard metric defined by the U.S. Securities and Exchange Commission (SEC) and reflects the dividends and interest earned during the period after the deduction of the ETF's expenses. There are no assurances that this yield will be sustainable in the future. This product invests in one or more ETFs. Results may vary due to expenses and other factors.

3. Stocks 500: Where applicable, as of December 31, 2025, S&P 500 return assumes an initial $1,000 investment, 40-year annualized return of 10% (Source: Bloomberg Finance LP). It is not possible to invest directly in an index. This product invests in an ETF aiming to track the S&P 500’s performance. Results may vary due to expenses and other factors. Returns before ETF fees. Diversification is not a guarantee of profit or protection against loss.

4. Wealth Builder: Saving $400/month over 40 years, but not investing and assuming no interest accrual, would accumulate $192,000; however, investing the same $400/month, could add up to over $1 million over the same period of time. This projection illustrates a hypothetical example of compounding over time, based on an investment of $400 per month for 40 years with an assumed annualized returns of 8% or more, compounded monthly, assuming the funds stay invested throughout the investment period.

5. All corporate logos are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.

6. App store rating is as of 12/31/2025, and is based upon all ratings and reviews received by Apple App Store and Google Play Store (collectively, the “App Stores”) submitted since the Beanstox app was available on each App Store. Current rating can be found on Beanstox’s app preview in each App Store and is subject to change. App Store rating is generally calculated and generated by each App Stores based on the average of all total Beanstox app ratings. No compensation was exchanged for reviews or ratings. Rating may not be representative of the Beanstox client experience, advisory services, or investment performance. For more information, see more reviews at the App Store and Google Play Store.

7. Beanstox Bitcoin is a self-directed portfolio and should not be considered to be a recommendation. Investing in digital assets, such as Bitcoins, is highly speculative and volatile, and only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Digital assets are not legal tender and are not backed by the U.S. government. Although exposure to Bitcoin can help further diversify your investment portfolios for the long-term, digital assets investments carry significant risk! Generally, you may want to consider limiting your digital assets allocation to no more than 5% of your investments. Even today, while Cryptocurrency is gaining a more prominent currency position, it’s still considered a highly volatile investment. Beanstox does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the iShares Bitcoin Trust ETF. This is considered a high-risk investment given the speculative and volatile nature of digital assets. Investing involves risk including the loss of principal.

8.Beanstox Gold is a self-directed portfolio and should not be considered to be a recommendation. Investing in commodities, such as gold, is speculative and can be volatile, and may only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Although exposure to gold can help further diversify your investment portfolios for the long-term, commodities carry significant risk. Generally, you may want to consider limiting your commodities allocation to no more than 10% of your investments. Beanstox does not provide access to invest directly in gold. Beanstox’s gold exposure is provided through the iShares Gold Trust. This is considered a high-risk investment given the speculative and volatile nature of commodities. Investing involves risk including the loss of principal.

New Products: We are excited about the development of new products, although there are no assurances that these products will be implemented or offered to Beanstox App users, or that final details on how the products will be offered will not differ from those currently contemplated.

Beanstox Inc. (“Beanstox”) is an SEC registered investment adviser and has arranged for brokerage services to be provided by DriveWealth LLC., a registered broker-dealer and member of FINRA/SIPC. DriveWealth is not affiliated with Beanstox.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and risk tolerance levels and Beanstox’s charges and expenses. The information provided herein is for illustrative purposes only and does not constitute personalized investment advice, recommendations or solicitations to hold, buy or sell any investment or security of any kind. Beanstox’s internet-based advisory services are designed to assist clients in achieving investment goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form ADV Part 2A and Part 3 CRS and other disclosures.

All images and return figures shown are for illustrative purposes only and are not actual customer or model returns. Actual returns will vary greatly and depend on personal and market conditions. Past performance does not guarantee future results. Google Play and the Google Play logo are trademarks of Google, Inc. Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S.

Our site uses cookies and other similar technologies so that we can remember you and understand how you and other visitors use our site. Please see Beanstox Privacy Policy for more information.

© 2026 Beanstox Inc.

Copyright © 2026 Beanstox. All Rights Reserved

Check Out the Beanstox App

Invest without stress. Easier than a walk in the park. No stock picking, no market timing and no experience needed.

Legal

Developers

Unless indicated differently, data is as of 12/31/2025.

*Disclosures

Beanstox does not provide tax, legal, accounting, budgeting, credit score, or banking advice. The information provided is for informational purposes only and is not intended to constitute such advice. Readers are encouraged to consult with their personal tax, legal, and accounting professionals for specific guidance.

** Open a Traditional IRA with Beanstox and boost your federal tax refund by up to $22 for every $100 you contribute by April 15, 2026 (or up to $1,540 assuming 22% on the maximum contribution of $7,000).

1. Pricing: Learn About Pricing.

2. Power Savings: As of Dec 31, 2025: traditional US Savings Account Rate: 0.39% (YCharts); T-Bill yield: 3.57% (YCharts); comparison based on 3.66%, the 30-day SEC yield of the Beanstox short-duration bond portfolio ETF constituents; the 30-day SEC yield is a standard metric defined by the U.S. Securities and Exchange Commission (SEC) and reflects the dividends and interest earned during the period after the deduction of the ETF's expenses. There are no assurances that this yield will be sustainable in the future. This product invests in one or more ETFs. Results may vary due to expenses and other factors.

3. Stocks 500: Where applicable, as of December 31, 2025, S&P 500 return assumes an initial $1,000 investment, 40-year annualized return of 10% (Source: Bloomberg Finance LP). It is not possible to invest directly in an index. This product invests in an ETF aiming to track the S&P 500’s performance. Results may vary due to expenses and other factors. Returns before ETF fees. Diversification is not a guarantee of profit or protection against loss.

4. Wealth Builder: Saving $400/month over 40 years, but not investing and assuming no interest accrual, would accumulate $192,000; however, investing the same $400/month, could add up to over $1 million over the same period of time. This projection illustrates a hypothetical example of compounding over time, based on an investment of $400 per month for 40 years with an assumed annualized returns of 8% or more, compounded monthly, assuming the funds stay invested throughout the investment period.

5. All corporate logos are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.

6. App store rating is as of 12/31/2025, and is based upon all ratings and reviews received by Apple App Store and Google Play Store (collectively, the “App Stores”) submitted since the Beanstox app was available on each App Store. Current rating can be found on Beanstox’s app preview in each App Store and is subject to change. App Store rating is generally calculated and generated by each App Stores based on the average of all total Beanstox app ratings. No compensation was exchanged for reviews or ratings. Rating may not be representative of the Beanstox client experience, advisory services, or investment performance. For more information, see more reviews at the App Store and Google Play Store.

7. Beanstox Bitcoin is a self-directed portfolio and should not be considered to be a recommendation. Investing in digital assets, such as Bitcoins, is highly speculative and volatile, and only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Digital assets are not legal tender and are not backed by the U.S. government. Although exposure to Bitcoin can help further diversify your investment portfolios for the long-term, digital assets investments carry significant risk! Generally, you may want to consider limiting your digital assets allocation to no more than 5% of your investments. Even today, while Cryptocurrency is gaining a more prominent currency position, it’s still considered a highly volatile investment. Beanstox does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the iShares Bitcoin Trust ETF. This is considered a high-risk investment given the speculative and volatile nature of digital assets. Investing involves risk including the loss of principal.

8.Beanstox Gold is a self-directed portfolio and should not be considered to be a recommendation. Investing in commodities, such as gold, is speculative and can be volatile, and may only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Although exposure to gold can help further diversify your investment portfolios for the long-term, commodities carry significant risk. Generally, you may want to consider limiting your commodities allocation to no more than 10% of your investments. Beanstox does not provide access to invest directly in gold. Beanstox’s gold exposure is provided through the iShares Gold Trust. This is considered a high-risk investment given the speculative and volatile nature of commodities. Investing involves risk including the loss of principal.

New Products: We are excited about the development of new products, although there are no assurances that these products will be implemented or offered to Beanstox App users, or that final details on how the products will be offered will not differ from those currently contemplated.

Beanstox Inc. (“Beanstox”) is an SEC registered investment adviser and has arranged for brokerage services to be provided by DriveWealth LLC., a registered broker-dealer and member of FINRA/SIPC. DriveWealth is not affiliated with Beanstox.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and risk tolerance levels and Beanstox’s charges and expenses. The information provided herein is for illustrative purposes only and does not constitute personalized investment advice, recommendations or solicitations to hold, buy or sell any investment or security of any kind. Beanstox’s internet-based advisory services are designed to assist clients in achieving investment goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form ADV Part 2A and Part 3 CRS and other disclosures.

All images and return figures shown are for illustrative purposes only and are not actual customer or model returns. Actual returns will vary greatly and depend on personal and market conditions. Past performance does not guarantee future results. Google Play and the Google Play logo are trademarks of Google, Inc. Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S.

Our site uses cookies and other similar technologies so that we can remember you and understand how you and other visitors use our site. Please see Beanstox Privacy Policy for more information.

© 2026 Beanstox Inc.

Copyright © 2026 Beanstox. All Rights Reserved

Check Out the Beanstox App

Invest without stress. Easier than a walk in the park. No stock picking, no market timing and no experience needed.

Legal

Developers

Unless indicated differently, data is as of 12/31/2025.

*Disclosures

Beanstox does not provide tax, legal, accounting, budgeting, credit score, or banking advice. The information provided is for informational purposes only and is not intended to constitute such advice. Readers are encouraged to consult with their personal tax, legal, and accounting professionals for specific guidance.

** Open a Traditional IRA with Beanstox and boost your federal tax refund by up to $22 for every $100 you contribute by April 15, 2026 (or up to $1,540 assuming 22% on the maximum contribution of $7,000).

1. Pricing: Learn About Pricing.

2. Power Savings: As of Dec 31, 2025: traditional US Savings Account Rate: 0.39% (YCharts); T-Bill yield: 3.57% (YCharts); comparison based on 3.66%, the 30-day SEC yield of the Beanstox short-duration bond portfolio ETF constituents; the 30-day SEC yield is a standard metric defined by the U.S. Securities and Exchange Commission (SEC) and reflects the dividends and interest earned during the period after the deduction of the ETF's expenses. There are no assurances that this yield will be sustainable in the future. This product invests in one or more ETFs. Results may vary due to expenses and other factors.

3. Stocks 500: Where applicable, as of December 31, 2025, S&P 500 return assumes an initial $1,000 investment, 40-year annualized return of 10% (Source: Bloomberg Finance LP). It is not possible to invest directly in an index. This product invests in an ETF aiming to track the S&P 500’s performance. Results may vary due to expenses and other factors. Returns before ETF fees. Diversification is not a guarantee of profit or protection against loss.

4. Wealth Builder: Saving $400/month over 40 years, but not investing and assuming no interest accrual, would accumulate $192,000; however, investing the same $400/month, could add up to over $1 million over the same period of time. This projection illustrates a hypothetical example of compounding over time, based on an investment of $400 per month for 40 years with an assumed annualized returns of 8% or more, compounded monthly, assuming the funds stay invested throughout the investment period.

5. All corporate logos are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.

6. App store rating is as of 12/31/2025, and is based upon all ratings and reviews received by Apple App Store and Google Play Store (collectively, the “App Stores”) submitted since the Beanstox app was available on each App Store. Current rating can be found on Beanstox’s app preview in each App Store and is subject to change. App Store rating is generally calculated and generated by each App Stores based on the average of all total Beanstox app ratings. No compensation was exchanged for reviews or ratings. Rating may not be representative of the Beanstox client experience, advisory services, or investment performance. For more information, see more reviews at the App Store and Google Play Store.

7. Beanstox Bitcoin is a self-directed portfolio and should not be considered to be a recommendation. Investing in digital assets, such as Bitcoins, is highly speculative and volatile, and only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Digital assets are not legal tender and are not backed by the U.S. government. Although exposure to Bitcoin can help further diversify your investment portfolios for the long-term, digital assets investments carry significant risk! Generally, you may want to consider limiting your digital assets allocation to no more than 5% of your investments. Even today, while Cryptocurrency is gaining a more prominent currency position, it’s still considered a highly volatile investment. Beanstox does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the iShares Bitcoin Trust ETF. This is considered a high-risk investment given the speculative and volatile nature of digital assets. Investing involves risk including the loss of principal.

8.Beanstox Gold is a self-directed portfolio and should not be considered to be a recommendation. Investing in commodities, such as gold, is speculative and can be volatile, and may only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Although exposure to gold can help further diversify your investment portfolios for the long-term, commodities carry significant risk. Generally, you may want to consider limiting your commodities allocation to no more than 10% of your investments. Beanstox does not provide access to invest directly in gold. Beanstox’s gold exposure is provided through the iShares Gold Trust. This is considered a high-risk investment given the speculative and volatile nature of commodities. Investing involves risk including the loss of principal.

New Products: We are excited about the development of new products, although there are no assurances that these products will be implemented or offered to Beanstox App users, or that final details on how the products will be offered will not differ from those currently contemplated.

Beanstox Inc. (“Beanstox”) is an SEC registered investment adviser and has arranged for brokerage services to be provided by DriveWealth LLC., a registered broker-dealer and member of FINRA/SIPC. DriveWealth is not affiliated with Beanstox.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and risk tolerance levels and Beanstox’s charges and expenses. The information provided herein is for illustrative purposes only and does not constitute personalized investment advice, recommendations or solicitations to hold, buy or sell any investment or security of any kind. Beanstox’s internet-based advisory services are designed to assist clients in achieving investment goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form ADV Part 2A and Part 3 CRS and other disclosures.

All images and return figures shown are for illustrative purposes only and are not actual customer or model returns. Actual returns will vary greatly and depend on personal and market conditions. Past performance does not guarantee future results. Google Play and the Google Play logo are trademarks of Google, Inc. Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S.

Our site uses cookies and other similar technologies so that we can remember you and understand how you and other visitors use our site. Please see Beanstox Privacy Policy for more information.

© 2026 Beanstox Inc.

Copyright © 2026 Beanstox. All Rights Reserved