Kevin O’Leary says “Now get over 5% on your cash with Beanstox, so it’s time to skip the banks!”

Beanstox launches free Power Savings Account that invests in T-Bill ETFs currently paying over 5%

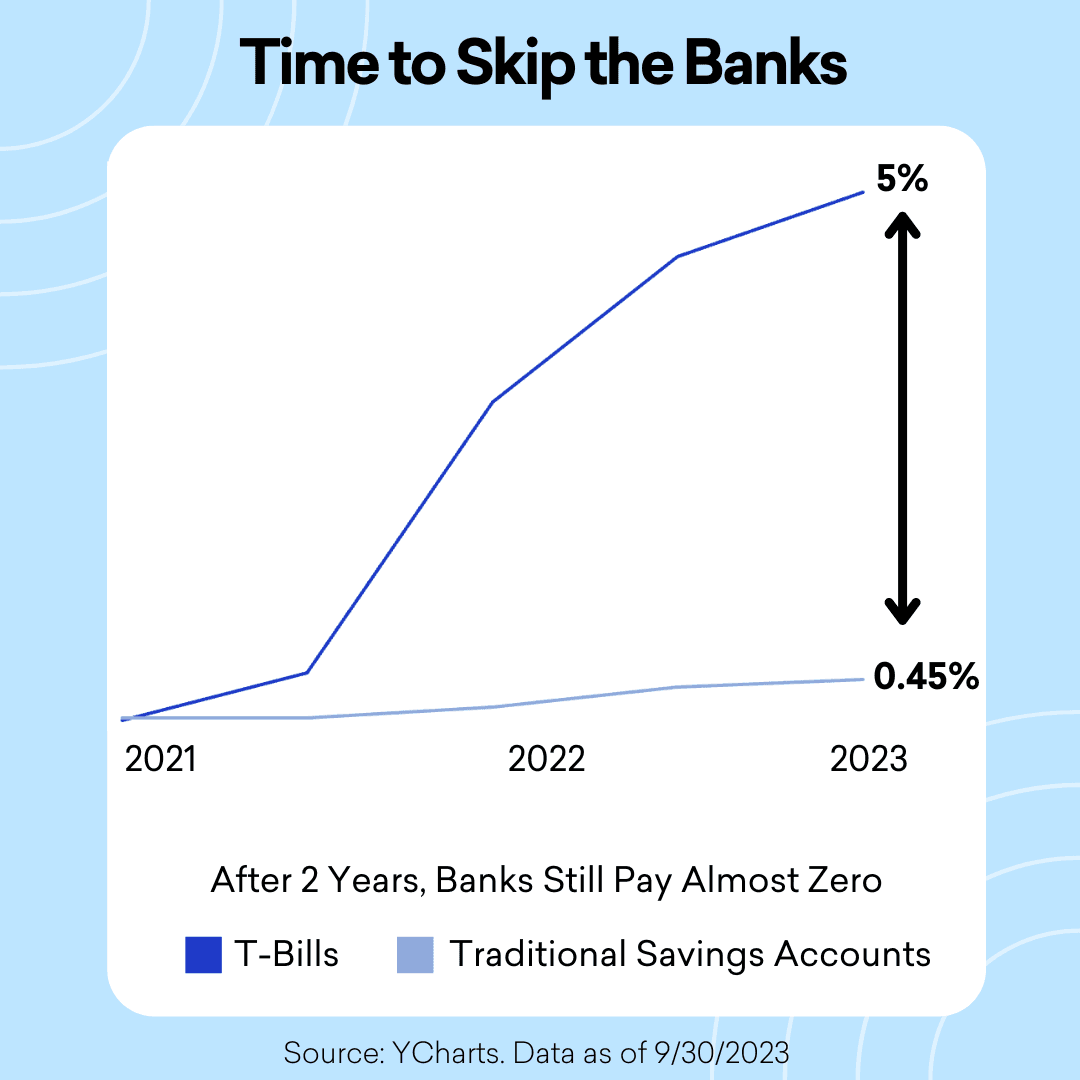

Boston, MA, December 14, 2023 – Beanstox announces a free¹ Power Savings account, aiming to help investors beat inflation by earning over 5% on cash invested in T-Bill ETFs². Income earned on US Government T-Bills is now over 5%, compared to traditional bank savings accounts still paying almost zero².

Kevin O’Leary, Beanstox Chairman/co-owner commented: “People need to get smart with their cash. Here’s what happened. Inflation increased, interest rates increased, and banks increased what they charge for mortgage loans and other types of loans. Did banks do much to increase what they pay customers on deposits in traditional bank savings accounts? No. Not much at all. The average US Savings Account rate is still not even 1%. So, I’ve moved cash into T-Bill ETFs that currently pay me over 5% on invested cash. Someday, when I want that cash, its easy to access, and there are no early withdrawal penalties. At Beanstox, we’ve made it easy for people to do the same as me with their invested cash. Now clients can get over 5% yield based on current rates. That’s more than 10 times what they might be getting on traditional savings accounts. Also, the Beanstox Powers Savings account is free. People should take better care of their cash, and then maybe tell friends how to skip the banks. Get over 5%.”

Connor O’Brien, CEO added: “At Beanstox, we help people to be smart with their cash, their savings, and their investing. ETFs that invest in T-Bills are a great low-risk way for people to invest. Why leave cash at the bank paying the customer almost zero, letting the bank get the profits of investing in T-Bills? Why not skip the banks to make the profit for yourself? Investing in T-Bills ETFs is now easier, no longer requiring big money or complicated accounts. People thinking about risk should know that T-Bills have a strong track record, and the US government has never defaulted on a payment of T-Bills. People who wonder about income tax should know that interest income from T-Bills is exempt from state and local taxes, which is a bonus compared to taxable income on bank savings accounts. At Beanstox, we make investing in T-Bill ETFs easy, automated, and free.”

Beanstox Power Savings Summary:

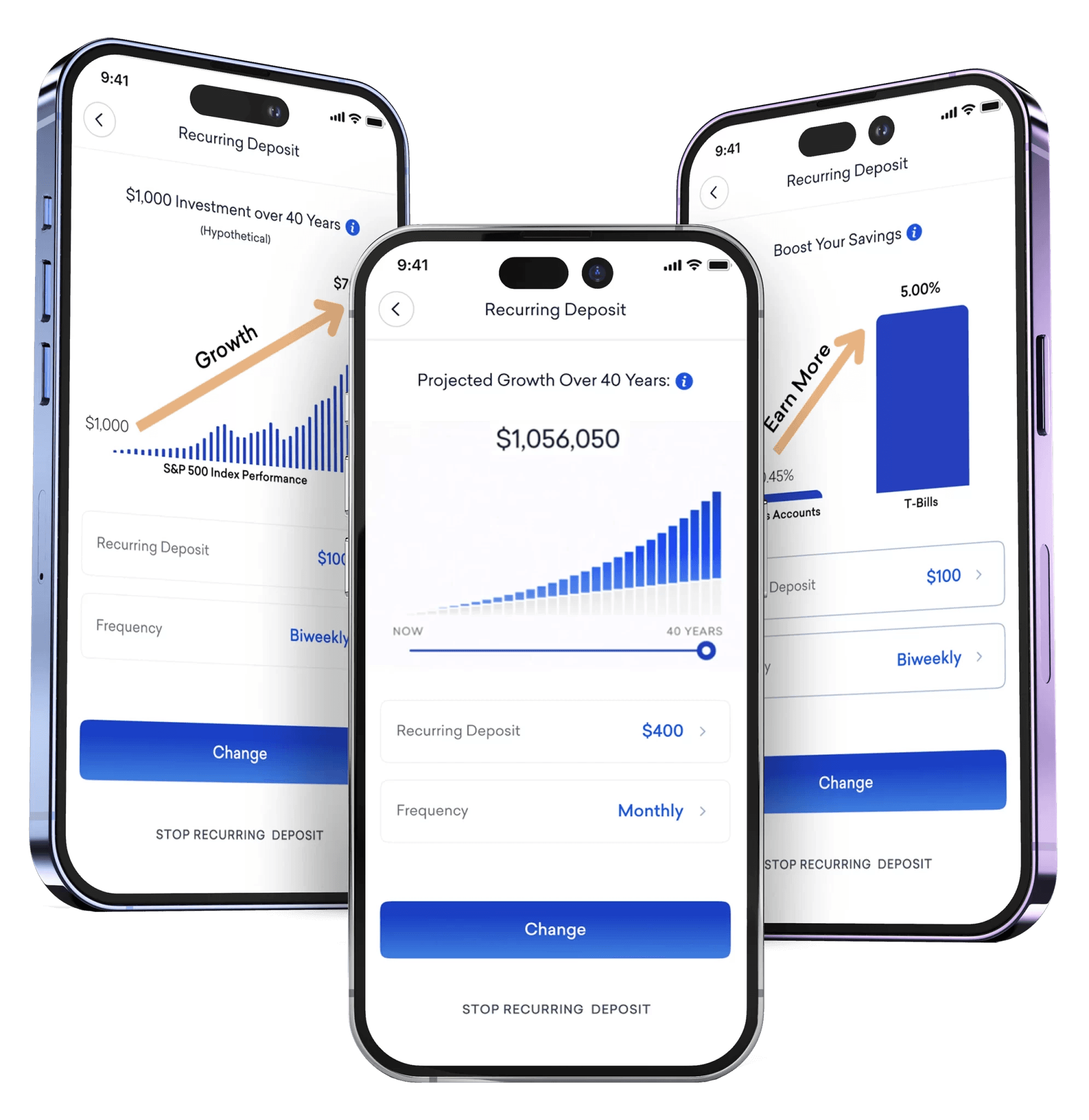

Investment account that invests in T-Bill ETFs currently yielding over 5%

Price: Free with Beanstox Simple. Included with Beanstox Plus

Advantages: Easy setup, recurring deposits to automate investing

About Beanstox.

Beanstox Inc. is an SEC-registered investment adviser designed for people who want automated, seriously simple investing. Brokerage services are provided by DriveWealth LLC., a registered broker-dealer and member of FINRA/SIPC. DriveWealth is not affiliated with Beanstox. Investing in securities involves risks, and there is always the potential of losing money when investing in securities. Before investing, investors should consider investment objectives and risk tolerance levels and Beanstox’s charges and expenses. This does not constitute personalized investment advice, recommendations, or solicitations to hold, buy, or sell any investment or security of any kind.

Media Contact

Louise Anne Poirier, Beanstox Inc., 1 617-878-2102, louiseanne@beanstox.com, https://beanstox.com/

Get Started With Beanstox

Set yourself up for a better future, with the freedom and security that come from having a growing portfolio. Download Beanstox and set up your automated recurring deposits today!

Learn with Beanstox

For a brief moment during the pandemic, investing looked like chaos disguised as opportunity.

For a brief moment during the pandemic, investing looked like chaos disguised as opportunity.

For a brief moment during the pandemic, investing looked like chaos disguised as opportunity.

A few minutes now can set up an entire year of progress.

A few minutes now can set up an entire year of progress.

A few minutes now can set up an entire year of progress.

Legal

Developers

Unless indicated differently, data is as of 12/31/2025.

*Disclosures

Beanstox does not provide tax, legal, accounting, budgeting, credit score, or banking advice. The information provided is for informational purposes only and is not intended to constitute such advice. Readers are encouraged to consult with their personal tax, legal, and accounting professionals for specific guidance.

** Open a Traditional IRA with Beanstox and boost your federal tax refund by up to $22 for every $100 you contribute by April 15, 2026 (or up to $1,540 assuming 22% on the maximum contribution of $7,000).

1. Pricing: Learn About Pricing.

2. Power Savings: As of Dec 31, 2025: traditional US Savings Account Rate: 0.39% (YCharts); T-Bill yield: 3.57% (YCharts); comparison based on 3.66%, the 30-day SEC yield of the Beanstox short-duration bond portfolio ETF constituents; the 30-day SEC yield is a standard metric defined by the U.S. Securities and Exchange Commission (SEC) and reflects the dividends and interest earned during the period after the deduction of the ETF's expenses. There are no assurances that this yield will be sustainable in the future. This product invests in one or more ETFs. Results may vary due to expenses and other factors.

3. Stocks 500: Where applicable, as of December 31, 2025, S&P 500 return assumes an initial $1,000 investment, 40-year annualized return of 10% (Source: Bloomberg Finance LP). It is not possible to invest directly in an index. This product invests in an ETF aiming to track the S&P 500’s performance. Results may vary due to expenses and other factors. Returns before ETF fees. Diversification is not a guarantee of profit or protection against loss.

4. Wealth Builder: Saving $400/month over 40 years, but not investing and assuming no interest accrual, would accumulate $192,000; however, investing the same $400/month, could add up to over $1 million over the same period of time. This projection illustrates a hypothetical example of compounding over time, based on an investment of $400 per month for 40 years with an assumed annualized returns of 8% or more, compounded monthly, assuming the funds stay invested throughout the investment period.

5. All corporate logos are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.

6. App store rating is as of 12/31/2025, and is based upon all ratings and reviews received by Apple App Store and Google Play Store (collectively, the “App Stores”) submitted since the Beanstox app was available on each App Store. Current rating can be found on Beanstox’s app preview in each App Store and is subject to change. App Store rating is generally calculated and generated by each App Stores based on the average of all total Beanstox app ratings. No compensation was exchanged for reviews or ratings. Rating may not be representative of the Beanstox client experience, advisory services, or investment performance. For more information, see more reviews at the App Store and Google Play Store.

7. Beanstox Bitcoin is a self-directed portfolio and should not be considered to be a recommendation. Investing in digital assets, such as Bitcoins, is highly speculative and volatile, and only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Digital assets are not legal tender and are not backed by the U.S. government. Although exposure to Bitcoin can help further diversify your investment portfolios for the long-term, digital assets investments carry significant risk! Generally, you may want to consider limiting your digital assets allocation to no more than 5% of your investments. Even today, while Cryptocurrency is gaining a more prominent currency position, it’s still considered a highly volatile investment. Beanstox does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the iShares Bitcoin Trust ETF. This is considered a high-risk investment given the speculative and volatile nature of digital assets. Investing involves risk including the loss of principal.

8.Beanstox Gold is a self-directed portfolio and should not be considered to be a recommendation. Investing in commodities, such as gold, is speculative and can be volatile, and may only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Although exposure to gold can help further diversify your investment portfolios for the long-term, commodities carry significant risk. Generally, you may want to consider limiting your commodities allocation to no more than 10% of your investments. Beanstox does not provide access to invest directly in gold. Beanstox’s gold exposure is provided through the iShares Gold Trust. This is considered a high-risk investment given the speculative and volatile nature of commodities. Investing involves risk including the loss of principal.

New Products: We are excited about the development of new products, although there are no assurances that these products will be implemented or offered to Beanstox App users, or that final details on how the products will be offered will not differ from those currently contemplated.

Beanstox Inc. (“Beanstox”) is an SEC registered investment adviser and has arranged for brokerage services to be provided by DriveWealth LLC., a registered broker-dealer and member of FINRA/SIPC. DriveWealth is not affiliated with Beanstox.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and risk tolerance levels and Beanstox’s charges and expenses. The information provided herein is for illustrative purposes only and does not constitute personalized investment advice, recommendations or solicitations to hold, buy or sell any investment or security of any kind. Beanstox’s internet-based advisory services are designed to assist clients in achieving investment goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form ADV Part 2A and Part 3 CRS and other disclosures.

All images and return figures shown are for illustrative purposes only and are not actual customer or model returns. Actual returns will vary greatly and depend on personal and market conditions. Past performance does not guarantee future results. Google Play and the Google Play logo are trademarks of Google, Inc. Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S.

Our site uses cookies and other similar technologies so that we can remember you and understand how you and other visitors use our site. Please see Beanstox Privacy Policy for more information.

© 2026 Beanstox Inc.

Copyright © 2026 Beanstox. All Rights Reserved

Legal

Developers

Unless indicated differently, data is as of 12/31/2025.

*Disclosures

Beanstox does not provide tax, legal, accounting, budgeting, credit score, or banking advice. The information provided is for informational purposes only and is not intended to constitute such advice. Readers are encouraged to consult with their personal tax, legal, and accounting professionals for specific guidance.

** Open a Traditional IRA with Beanstox and boost your federal tax refund by up to $22 for every $100 you contribute by April 15, 2026 (or up to $1,540 assuming 22% on the maximum contribution of $7,000).

1. Pricing: Learn About Pricing.

2. Power Savings: As of Dec 31, 2025: traditional US Savings Account Rate: 0.39% (YCharts); T-Bill yield: 3.57% (YCharts); comparison based on 3.66%, the 30-day SEC yield of the Beanstox short-duration bond portfolio ETF constituents; the 30-day SEC yield is a standard metric defined by the U.S. Securities and Exchange Commission (SEC) and reflects the dividends and interest earned during the period after the deduction of the ETF's expenses. There are no assurances that this yield will be sustainable in the future. This product invests in one or more ETFs. Results may vary due to expenses and other factors.

3. Stocks 500: Where applicable, as of December 31, 2025, S&P 500 return assumes an initial $1,000 investment, 40-year annualized return of 10% (Source: Bloomberg Finance LP). It is not possible to invest directly in an index. This product invests in an ETF aiming to track the S&P 500’s performance. Results may vary due to expenses and other factors. Returns before ETF fees. Diversification is not a guarantee of profit or protection against loss.

4. Wealth Builder: Saving $400/month over 40 years, but not investing and assuming no interest accrual, would accumulate $192,000; however, investing the same $400/month, could add up to over $1 million over the same period of time. This projection illustrates a hypothetical example of compounding over time, based on an investment of $400 per month for 40 years with an assumed annualized returns of 8% or more, compounded monthly, assuming the funds stay invested throughout the investment period.

5. All corporate logos are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.

6. App store rating is as of 12/31/2025, and is based upon all ratings and reviews received by Apple App Store and Google Play Store (collectively, the “App Stores”) submitted since the Beanstox app was available on each App Store. Current rating can be found on Beanstox’s app preview in each App Store and is subject to change. App Store rating is generally calculated and generated by each App Stores based on the average of all total Beanstox app ratings. No compensation was exchanged for reviews or ratings. Rating may not be representative of the Beanstox client experience, advisory services, or investment performance. For more information, see more reviews at the App Store and Google Play Store.

7. Beanstox Bitcoin is a self-directed portfolio and should not be considered to be a recommendation. Investing in digital assets, such as Bitcoins, is highly speculative and volatile, and only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Digital assets are not legal tender and are not backed by the U.S. government. Although exposure to Bitcoin can help further diversify your investment portfolios for the long-term, digital assets investments carry significant risk! Generally, you may want to consider limiting your digital assets allocation to no more than 5% of your investments. Even today, while Cryptocurrency is gaining a more prominent currency position, it’s still considered a highly volatile investment. Beanstox does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the iShares Bitcoin Trust ETF. This is considered a high-risk investment given the speculative and volatile nature of digital assets. Investing involves risk including the loss of principal.

8.Beanstox Gold is a self-directed portfolio and should not be considered to be a recommendation. Investing in commodities, such as gold, is speculative and can be volatile, and may only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Although exposure to gold can help further diversify your investment portfolios for the long-term, commodities carry significant risk. Generally, you may want to consider limiting your commodities allocation to no more than 10% of your investments. Beanstox does not provide access to invest directly in gold. Beanstox’s gold exposure is provided through the iShares Gold Trust. This is considered a high-risk investment given the speculative and volatile nature of commodities. Investing involves risk including the loss of principal.

New Products: We are excited about the development of new products, although there are no assurances that these products will be implemented or offered to Beanstox App users, or that final details on how the products will be offered will not differ from those currently contemplated.

Beanstox Inc. (“Beanstox”) is an SEC registered investment adviser and has arranged for brokerage services to be provided by DriveWealth LLC., a registered broker-dealer and member of FINRA/SIPC. DriveWealth is not affiliated with Beanstox.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and risk tolerance levels and Beanstox’s charges and expenses. The information provided herein is for illustrative purposes only and does not constitute personalized investment advice, recommendations or solicitations to hold, buy or sell any investment or security of any kind. Beanstox’s internet-based advisory services are designed to assist clients in achieving investment goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form ADV Part 2A and Part 3 CRS and other disclosures.

All images and return figures shown are for illustrative purposes only and are not actual customer or model returns. Actual returns will vary greatly and depend on personal and market conditions. Past performance does not guarantee future results. Google Play and the Google Play logo are trademarks of Google, Inc. Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S.

Our site uses cookies and other similar technologies so that we can remember you and understand how you and other visitors use our site. Please see Beanstox Privacy Policy for more information.

© 2026 Beanstox Inc.

Copyright © 2026 Beanstox. All Rights Reserved

Legal

Developers

Unless indicated differently, data is as of 12/31/2025.

*Disclosures

Beanstox does not provide tax, legal, accounting, budgeting, credit score, or banking advice. The information provided is for informational purposes only and is not intended to constitute such advice. Readers are encouraged to consult with their personal tax, legal, and accounting professionals for specific guidance.

** Open a Traditional IRA with Beanstox and boost your federal tax refund by up to $22 for every $100 you contribute by April 15, 2026 (or up to $1,540 assuming 22% on the maximum contribution of $7,000).

1. Pricing: Learn About Pricing.

2. Power Savings: As of Dec 31, 2025: traditional US Savings Account Rate: 0.39% (YCharts); T-Bill yield: 3.57% (YCharts); comparison based on 3.66%, the 30-day SEC yield of the Beanstox short-duration bond portfolio ETF constituents; the 30-day SEC yield is a standard metric defined by the U.S. Securities and Exchange Commission (SEC) and reflects the dividends and interest earned during the period after the deduction of the ETF's expenses. There are no assurances that this yield will be sustainable in the future. This product invests in one or more ETFs. Results may vary due to expenses and other factors.

3. Stocks 500: Where applicable, as of December 31, 2025, S&P 500 return assumes an initial $1,000 investment, 40-year annualized return of 10% (Source: Bloomberg Finance LP). It is not possible to invest directly in an index. This product invests in an ETF aiming to track the S&P 500’s performance. Results may vary due to expenses and other factors. Returns before ETF fees. Diversification is not a guarantee of profit or protection against loss.

4. Wealth Builder: Saving $400/month over 40 years, but not investing and assuming no interest accrual, would accumulate $192,000; however, investing the same $400/month, could add up to over $1 million over the same period of time. This projection illustrates a hypothetical example of compounding over time, based on an investment of $400 per month for 40 years with an assumed annualized returns of 8% or more, compounded monthly, assuming the funds stay invested throughout the investment period.

5. All corporate logos are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.

6. App store rating is as of 12/31/2025, and is based upon all ratings and reviews received by Apple App Store and Google Play Store (collectively, the “App Stores”) submitted since the Beanstox app was available on each App Store. Current rating can be found on Beanstox’s app preview in each App Store and is subject to change. App Store rating is generally calculated and generated by each App Stores based on the average of all total Beanstox app ratings. No compensation was exchanged for reviews or ratings. Rating may not be representative of the Beanstox client experience, advisory services, or investment performance. For more information, see more reviews at the App Store and Google Play Store.

7. Beanstox Bitcoin is a self-directed portfolio and should not be considered to be a recommendation. Investing in digital assets, such as Bitcoins, is highly speculative and volatile, and only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Digital assets are not legal tender and are not backed by the U.S. government. Although exposure to Bitcoin can help further diversify your investment portfolios for the long-term, digital assets investments carry significant risk! Generally, you may want to consider limiting your digital assets allocation to no more than 5% of your investments. Even today, while Cryptocurrency is gaining a more prominent currency position, it’s still considered a highly volatile investment. Beanstox does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the iShares Bitcoin Trust ETF. This is considered a high-risk investment given the speculative and volatile nature of digital assets. Investing involves risk including the loss of principal.

8.Beanstox Gold is a self-directed portfolio and should not be considered to be a recommendation. Investing in commodities, such as gold, is speculative and can be volatile, and may only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Although exposure to gold can help further diversify your investment portfolios for the long-term, commodities carry significant risk. Generally, you may want to consider limiting your commodities allocation to no more than 10% of your investments. Beanstox does not provide access to invest directly in gold. Beanstox’s gold exposure is provided through the iShares Gold Trust. This is considered a high-risk investment given the speculative and volatile nature of commodities. Investing involves risk including the loss of principal.

New Products: We are excited about the development of new products, although there are no assurances that these products will be implemented or offered to Beanstox App users, or that final details on how the products will be offered will not differ from those currently contemplated.

Beanstox Inc. (“Beanstox”) is an SEC registered investment adviser and has arranged for brokerage services to be provided by DriveWealth LLC., a registered broker-dealer and member of FINRA/SIPC. DriveWealth is not affiliated with Beanstox.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and risk tolerance levels and Beanstox’s charges and expenses. The information provided herein is for illustrative purposes only and does not constitute personalized investment advice, recommendations or solicitations to hold, buy or sell any investment or security of any kind. Beanstox’s internet-based advisory services are designed to assist clients in achieving investment goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form ADV Part 2A and Part 3 CRS and other disclosures.

All images and return figures shown are for illustrative purposes only and are not actual customer or model returns. Actual returns will vary greatly and depend on personal and market conditions. Past performance does not guarantee future results. Google Play and the Google Play logo are trademarks of Google, Inc. Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S.

Our site uses cookies and other similar technologies so that we can remember you and understand how you and other visitors use our site. Please see Beanstox Privacy Policy for more information.

© 2026 Beanstox Inc.

Copyright © 2026 Beanstox. All Rights Reserved